In just a few days, the EU’s Carbon Border Adjustment Mechanism (CBAM) will officially enter its transitional phase, starting October 1, 2023. Proactively adapting to CBAM is a challenge for many businesses in Vietnam, especially those in industries like steel, aluminum, cement,…

- CBAM & Electricity Emissions: What Businesses Need to Know

- Ho Chi Minh City needs a breakthrough development mechanism to pioneer in neutralizing emissions

What is the Carbon Border Adjustment Mechanism (CBAM)?

The European Union’s CBAM is an environmental trade policy that includes carbon taxes on imported goods entering the EU market. These taxes are based on the greenhouse gas emissions intensity during the production process in their country of origin.

CBAM is issued as the EU aims to achieve carbon neutrality by 2050. This mechanism aims to balance the carbon price between domestically produced and imported products, thus preventing the risk of “carbon leakage.” Carbon leakage occurs when EU businesses move production activities with high carbon emissions to countries to take advantage of lax standards. The EU believes that a green mechanism applied to imported goods through a carbon pricing system will encourage cleaner industries in countries outside the EU.

Under this mechanism, importers of goods into the EU must register with domestic regulatory authorities and purchase CBAM emission certificates if the emissions in the imported goods exceed EU standards (the certificate price will be based on the weekly emission permit prices from the EU Emissions Trading System). Importers in the EU will declare the emission content in their imported goods and submit the corresponding number of certificates each year. If importers can prove that carbon prices have been paid while producing those goods, the corresponding emissions can be deducted.

Therefore, the EU is the world’s first trading region to impose carbon pricing on imported goods.

The CBAM implementation timeline

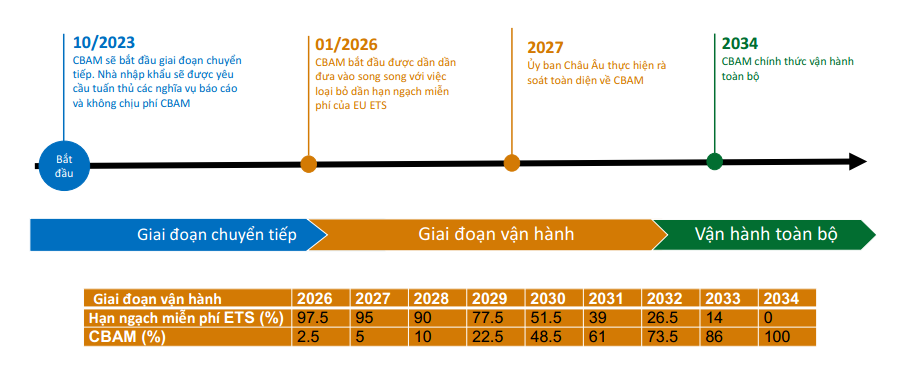

The CBAM mechanism is divided into three phases:

Transition Phase: From October 1, 2023, to the end of 2025, importers must report on the goods affected by CBAM. The first reporting phase for importers concludes on January 31, 2024. During the transition phase, EU importers won’t have to make any financial payments or adjustments. Initially, CBAM will focus on product categories with the highest risk of carbon leakage, including cement, iron and steel, aluminum, fertilizers, hydrogen, and electricity. These sectors account for up to 94% of the EU’s industrial greenhouse gas emissions. At the end of this phase, in 2025, the European Commission (EC) will evaluate CBAM’s performance and may expand its scope to include more products and services, such as value chains and possibly indirect emissions.

2026-2034 Phase: CBAM starts operating, and EU importers of goods within CBAM’s scope must purchase CBAM certificates. Before May 31 each year, EU importers must declare the quantity of goods and associated emissions in goods imported in the previous year. Simultaneously, importers must submit the corresponding number of CBAM certificates for the greenhouse gas emissions present in the products. The EU will gradually phase out the allocation of free greenhouse gas emission permits.

From 2034: CBAM becomes fully operational, and businesses must submit 100% of the CBAM fees.

Urgent challenges for affected industries

Cement, iron and steel, aluminum, fertilizers, hydrogen, and electricity are the first industries to be impacted by CBAM. In Vietnam, four sectors significantly export goods to the EU market: aluminum, steel, cement, and fertilizers. Notably, products made from iron and steel alone account for 96% of the value of these four exported goods. In the first six months of this year, Vietnam has exported over 1.36 million tons of steel to Europe, a nearly 34% increase compared to the same period in 2022, making up about 21% of the total steel export structure.

Therefore, this poses a new challenge for businesses in these industries, especially the steel sector. If steel manufacturers in Vietnam do not plan to reduce carbon emissions and take action quickly, their export products will face tough competition and might lose market share.

The World Trade Organization (WTO) estimates that the steel industry may see a 4% reduction in export value due to CBAM’s impact. The reduced demand will lead to approximately a 0.8% decrease in production, along with adverse effects on competitiveness in the market.

In contrast, according to a World Bank assessment of the carbon tax’s impact on three countries, including Vietnam, Thailand, and India, conducted in May 2021, the carbon tax from CBAM could increase the annual costs by $36 billion for three products: steel, cement, and aluminum, which Vietnam exports to the European market.

A new challenge for all businesses in the international market

CBAM is currently one of the most critical issues of concern, mainly because the EU is an attractive market for Vietnamese businesses. This attraction arises from the EU’s high purchasing power and the promising and effective EVFTA (EU-Vietnam Free Trade Agreement). According to statistics, within the first two years of implementing the EVFTA (from August 2020 to July 2022), Vietnam’s total exports to the EU reached $83.4 billion, averaging $41.7 billion per year. This is a remarkable 24% increase compared to the average export value from 2016 to 2019.

Meanwhile, CBAM could expand its scope to cover more products and services as the EC assesses its operations in 2025.

The EU’s CBAM mechanism again demonstrates that global regulations and criteria are becoming increasingly stringent to closely link economic activities and international trade with environmental protection, climate adaptation, and carbon neutrality goals. Many experts believe that in the future, more large countries and markets like the United States, Japan, South Korea, and others may adopt similar policies and mechanisms and expand their coverage to various product categories. Therefore, Vietnamese businesses engaged in the international market across all sectors, such as textiles, plastics, leather and footwear, wood,… should proactively adapt to these new trends and make the necessary preparations when developing and planning production strategies.

Especially for complex product categories, the EU will consider emissions from input materials. Therefore, businesses must thoroughly account for and report on input materials throughout production, transportation, and consumption processes, not just during production.

To green production, businesses can begin by investing in cleaner production technologies and practices, actively implementing energy-saving measures, and utilizing renewable energy sources like solar power. These actions can help reduce production costs, lower product carbon emissions, meet green standards, and enhance long-term competitiveness.

Shifting to green manufacturing is critical not just for individual businesses, but also for the whole supply chain. When a supplier reduces emissions, the businesses in the supply chain go closer to their Net Zero and emission reduction goals. When a network of companies collaborates to reduce emissions and achieve carbon neutrality, they gain a competitive advantage in the international market and open up opportunities in the face of the common challenge of carbon taxes.

|

As a leading renewable energy company in Vietnam, Vu Phong Energy Group specializes in developing solar power. We are walking alongside many businesses on their green transformation journey, helping them reduce emissions, especially through Power Purchase Agreement (PPA). This flexible cooperation model is a top choice for many businesses because it addresses financial concerns. Companies don’t need to invest capital or manage system operations. Instead, they can access solar power at a lower cost and receive a free system transfer after the contract period. Many industry-leading companies in Vietnam, such as Vinamilk, Kem Nghia, Duy Tan, and Dalat Worsted Spinning – DWS,… are opting for this solution as part of their green transformation process. Businesses interested in clean energy solutions, please contact Our Call Center via 1800 7171 hoặc +84 9 1800 7171 hoặc qua email hello@vuphong.com information. |

Vu Phong Energy Group

*Cover image source: Internet

Read more: