On April 22, 2024, the Ho Chi Minh city Institute for Development Studies (HIDS) organized a scientific seminar titled: “Development of the carbon credit market in Ho Chi Minh City.” The event attracted participation from businesses, experts, and scientists… During the three-hour session, the advisory board implemented “Resolution No. 98/2023/QH15 of the National Assembly on piloting certain mechanisms and policies […]

Currently browsing: Energy News

Businesses must proactively participate in the carbon credit market

Many large corporations have come to Vietnam to purchase carbon credits through financial mechanisms, while reducing emissions for Vietnamese businesses is an essential requirement in the global game. Without preemptive preparation, Vietnamese enterprises risk being slow and paying a high price, even facing survival risks against the “green barriers”. Many “key players” support the carbon credit market and green transitioning […]

Highlight activities of Vu Phong Energy Group in march 2024

In March 2024, several strategic activities took place, including the participation of Mr. Phong, Pham Nam – Chairman of the Board of Directors of Vu Phong Energy Group – in a program to meet with the community of innovation and creativity in Ho Chi Minh City (HCMC) organized by the People’s Committee of HCMC. Repositioning the member company – VP […]

Chairman of the BODs of Vu Phong Energy Group met and shared with Ho Chi Minh City leadership and community of innovation and creativity

On the morning of March 28, 2024, the People’s Committee of Ho Chi Minh City (HCMC) organized a program to meet with the community of innovation and creativity in HCMC. Attending the program, Mr. Phong, Pham Nam – Chairman of the Board of Directors of Vu Phong Energy Group – along with some experts in the community of innovation and […]

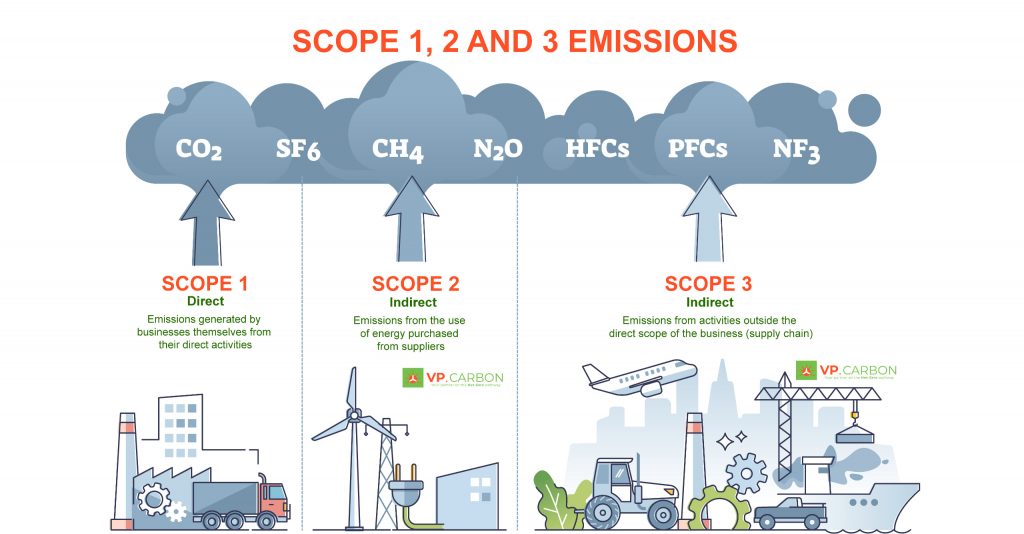

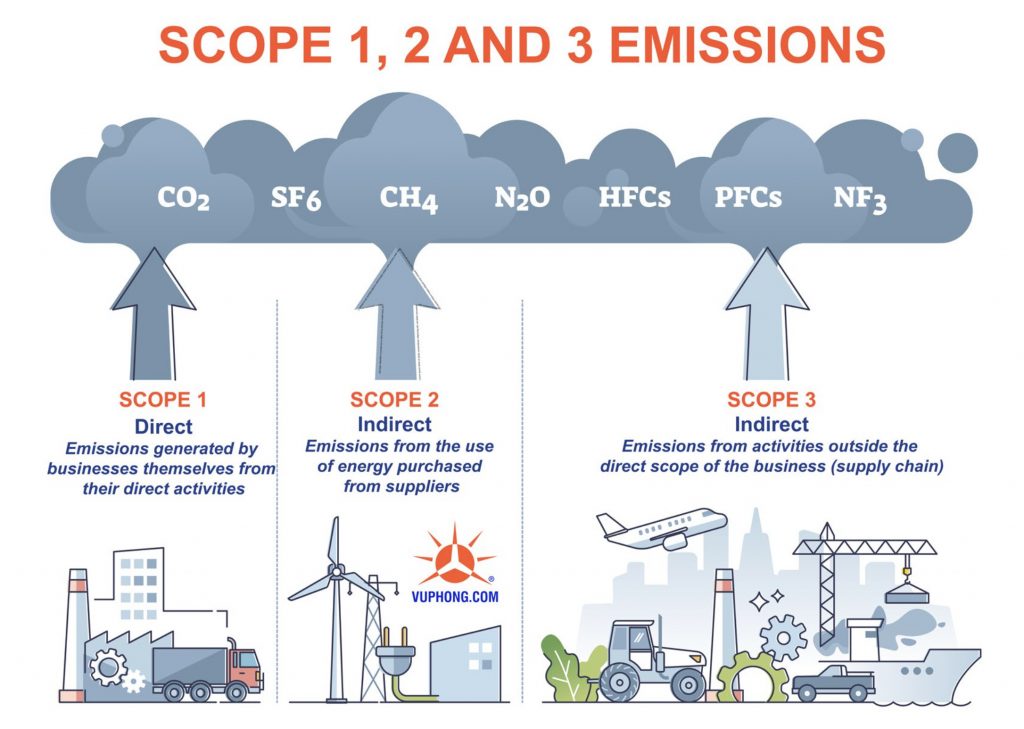

Greenhouse gas inventory and carbon neutrality consulting services – Net Zero for businesses

Greenhouse gas inventory is the first important step in helping businesses understand their emission situation, thereby developing reasonable and effective plans to reduce greenhouse gas emissions. What are greenhouse gas and which businesses need greenhouse gas inventory? Greenhouse gas & greenhouse gas inventory According to the Environmental Protection Law (issued on November 17, 2020), greenhouse gas are gas in the […]

Reducing Carbon footprint towards Net Zero

“Reducing Carbon footprint towards Net Zero” is the theme launched by the World Wide Fund for Nature (WWF) in the 2024 Earth Hour Campaign (taking place from 8:30 p.m. to 9:30 p.m. on March 23, 2024). Originating from a lights out event in Sydney, Australia 2007, Earth Hour – initiated by WWF – has become an annual global movement for […]

Become a partner in electric vehicle charging station installation – No investment cost

The global trend of using electric vehicles globally and in Vietnam opens up strong growth prospects for public electric charging services to serve green vehicles soon. Becoming a partner in installing electric vehicle charging stations with Vu Phong Energy Group requires no investment, and partners will share revenue from this potential market. How do we cooperate in installing electric vehicle […]

Clean energy technology helps reduce global emissions

In 2023, global CO2 emissions related to energy increased by 410 million tons – equivalent to a 1.1% rise; lower than the increase of 490 million tons (1.3%) in 2022. According to the IEA, clean energy technologies (solar energy, wind, nuclear energy, heat pumps, and electric cars) played a crucial role in reducing emission growth during the period 2019-2023. Nearly […]

US develops solar farm with over 3,200 MWh storage capacity

With a capacity of 875 MW and a storage capability of 3,287 MWh, the Edwards & Sanborn Solar and Energy Storage facility in the Mojave Desert, California, USA, has become the world’s largest solar and battery storage project. Construction of the Edwards & Sanborn Solar and Energy Storage facility began in early 2021, commenced operations in February 2023, and was […]

Nearly 510 GW of renewable energy added in 2023

With the addition of nearly 510 GW, the global renewable energy growth rate in 2023 has reached its fastest pace in two decades. According to the International Energy Agency (IEA) report, three-quarters of this added capacity comes from solar power. A new record for 22 consecutive years According to the Renewable Energy 2023 report: Analysis and Forecast until 2028, recently […]

Unlocking Vietnam’s Carbon Credit Market Potential

Vietnam has significant potential to grow its carbon credit market, especially as the global shift towards green transition and emission reduction to combat climate change gains momentum. To seize the opportunities presented by the development of the carbon credit market, businesses will need to overcome several challenges, starting with meeting international standards… Developing the carbon credit market in Vietnam According […]

Vu Phong Energy Group announces the 2024 Lunar New Year holiday

On the Lunar New Year 2024, the Board of Directors and all Vu Phong Energy Group members wish our Customers and Partners a New Year filled with peace, happiness, and abundant prosperity. Vu Phong Energy Group wishes you abundant health and energy to confidently stride forward and achieve many new successes in the journey of green transition in the coming […]

C47 continues 16-Year streak in the Top 500 Largest Private Enterprises in Vietnam

Construction Joint Stock Company 47 (HOSE: C47) has been honored again in the Top 500 Largest Private Enterprises in Vietnam in 2023 – part of the VNR500 rankings, marking the 16th consecutive year of achieving this recognition. C47 prioritizes hydroelectric and irrigation projects in Vietnam and Laos Global collaboration in wind project development and implementation in Vietnam C47 Celebrated 16 […]

Special Edition: Green Transition Handbook for Businesses

The global green transition is very strong worldwide. It is considered the common path globally, driven by the highest authorities, including Governments. Green transition is not just a trend; it’s an essential journey for businesses to thrive in the market, enhance competitiveness, and achieve sustainable development. In November 2021, at the COP26 conference, Prime Minister Pham Minh Chinh announced Vietnam’s […]

Another member of the An Phat Holdings ecosystem uses renewable energy

On January 6, 2024, Export Import Development Investment Company Limited (VIEXIM), a subsidiary of Hanoi Plastics JSC, signed a collaboration agreement with VP Energy and Vu Phong Energy Group to develop a rooftop solar power system at the factory in Yen My district, Hung Yen province. With this agreement, VIEXIM becomes the latest member of An Phat Holdings’ ecosystem to […]

Solar for House: Harnessing the Power of Solar Energy for Your Home

Harnessing the sun’s limitless energy, Solar for House initiatives in 2024 have transformed residential power consumption. With advancements in photovoltaic technology, homeowners are now empowered to not only diminish their carbon footprint but also enhance their property’s value and achieve energy autonomy. The installation of solar panels is no longer just an eco-conscious choice; it’s a financially savvy move, thanks […]

What may you not know about the carbon credit market?

The carbon credit market is emerging as a critical component in the global effort to mitigate greenhouse gas emissions. This market is experiencing a significant uptick in activity, characterized by an increase in both the number and diversity of trading exchanges and institutions. As we delve deeper into this article, we will explore a range of intriguing details about carbon […]

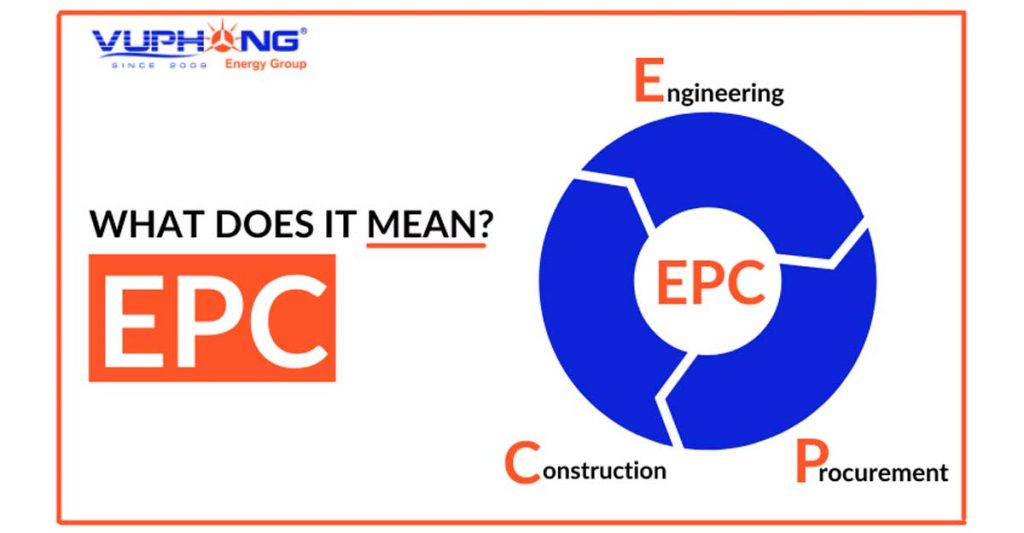

What is EPC Contract? Everything You Need to Know

This composition will elucidate the concept of an EPC contract, delineate the duties of an EPC general contractor, and highlight the manifold advantages that an EPC contract offers to investors. What is EPC? EPC, short for Engineering, Procurement, and Construction, refers to the design-build construction of solar photovoltaic energy systems. SWELECT (It is combined from “SWE” and “ELLECT,” where “SWE” […]

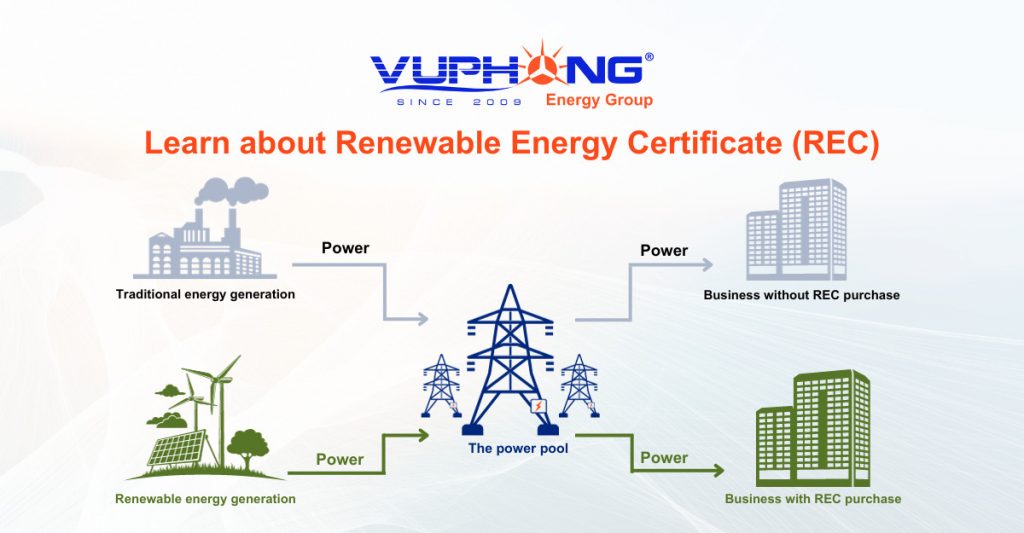

VP Carbon shared about the carbon market and RECs market

ACA-Vietnam, a member of ACA (Alliances for Climate Action), collaborated with WWF-Vietnam and VP Carbon to organize an end-of-year program for members on December 22, 2023. Mr. An, Pham Dang, Director of VP Carbon and Deputy General Director of Vu Phong Energy Group, coordinated the program and shared views on the carbon market and Renewable Energy Certificates (RECs) market with […]

High quality solar power system from PPA model

What is the PPA (Power Purchase Agreement) Model? The PPA model, a cornerstone of the Vu Phong Energy Group’s operations, is a contractual framework that facilitates the buying and selling of energy. This long-term agreement, spanning 10 to 25 years, is established between an electricity producer and a consumer. It enables customers to enter into contracts with third-party developers to […]

Many opportunities for energy collaboration between Ho Chi Minh City and Chungbuk – Korea

Ho Chi Minh City (HCMC) and Chungbuk (or Chungcheongbuk – Korea) can collaborate to develop economic sectors that apply digital technology and smart technology for sustainable development, focusing on an opportunity in the energy sector… by harnessing the strengths of each region. The Chungbuk Provincial Council hosted the HCMC – Chungbuk Business Forum on the afternoon of December 18 in […]

Vietnam Energy and Technology Forum 2023 on localization in renewable energy

On the afternoon of December 14, the 6th Vietnam Energy and Technology Forum 2023 took place in Hanoi, organized by the Ministry of Science and Technology, Ministry of Industry and Trade, and Germany’s Federal Ministry for Economic Affairs and Climate Action (BMWK); and coordinated by the Department of Technology Application and Development, Department of Electricity and Renewable Energy in collaboration […]

Renewable energy has more leverage from the COP28

The introduction of a green finance platform, climate investment funds, and over 120 nations’ commitment to triple global renewable energy capacity by 2030… These are the highlights of the COP28 Conference, which have been recognized as important milestones in reducing global carbon emissions and promoting renewable energy development. Nearly 120 countries commit to renewable energy goals During the COP28 Conference, […]

Numerous activities of Vu Phong Energy Group in November 2023

In November 2023, in addition to continuing to implement projects, sign new projects, and deliver completed systems, Vu Phong Energy Group participated in many sharing activities at major conferences, seminars, and forums related to sustainable development and the energy transition in Vietnam. Details of Vu Phong Energy Group’s outstanding activities in November, let’s read Vu Phong Magazine November 2023 Desktop […]

Rooftop Solar: Powering Vietnam’s Green Industrial Zones

The 2nd Technical Working Group on Renewable Energy held its second meeting of 2023 on the afternoon of November 24th, within the Vietnam Energy Partnership Group (VEPG) partnership framework. During the meeting, representatives updated, shared, and discussed various topics related to promoting the development of renewable energy sources and energy transition in Vietnam, including insights into rooftop solar for industrial […]

The Theme of CiC 2023: Digital Innovation – Green Transformation

The final round of the Creative Idea Challenge – CiC 2023 was held on November 25, 2023, in Ho Chi Minh City. Mr. Tri, Nguyen Quang, General Director of Vu Phong Energy Group, attended and awarded scholarships totaling 60 million VND to the top student teams. Vu Phong Energy Group’s highlighted activities in August 2022 Promoting sustainable development for businesses […]

C47 and EVNPECC3 signed an EPC contract worth nearly 185 million USD for a hydropower project in Laos

On November 22, 2023, in the capital Vientiane, Laos, Phongsupthavy Group Company, along with the contractor consortium led by Construction Joint Stock Company 47 (HOSE: C47) and Power Engineering Consulting Joint Stock Company 3 (EVNPECC3), held a signing ceremony for the EPC (Engineering, Procurement, and Construction) contract titled “Design, supply, installation of hydraulic machinery and construction of the project” for […]

Handing over the rooftop solar power system of Duy Tan Binh Duong plastics factory

The rooftop solar power system of Duy Tan Plastics Company, a subsidiary of Duy Tan Plastics Manufacturing Corporation, in Binh Duong, has a capacity of 2.17 MWp. The system contains 16 SMA 110kW inverters and 3,289 high-performance 660W Canadian solar panels. On November 22, 2023, the system was officially handed over. Clean energy solution for the plastic industry VP cooperates […]

Promoting sustainable development for businesses

On the afternoon of November 14, in Ho Chi Minh City, the opening session of the program “Innovation and Sustainable Development” and the Annual summit on Unlocking business potential for sustainable development took place. Mr. An, Pham Dang, Deputy General Director of Vu Phong Energy Group, and Director of VP Carbon, attended and participated in the panel discussion as part […]

RECs and the energy transition trend in Vietnam

Recognize RECs to contribute to the development of renewable energy, to reach 100% renewable energy and the Net Zero objective in Vietnam. This perspective was offered by Mr. An, Pham Dang, Director of VP Carbon and Deputy General Director of Vu Phong Energy Group, at a Seminar on the transition to net-zero emissions on November 7, 2023. Understanding the Significance […]

Outstanding activities of Vu Phong Energy Group in October 2023

In the first month of Q4 2023, Vu Phong Energy Group continues to advance rooftop solar projects. Furthermore, negotiations are underway to accompany numerous businesses on the green transformation and sustainable development journey. Details of Vu Phong Energy Group’s outstanding activities in October, let’s read Vu Phong Magazine October 2023 Desktop Version: Read Magazine Mobile Version: Read Magazine Engagement with […]

Overview of Renewable Energy Certificate (REC)

An International Renewable Energy Certificate (I-REC) is a type of Energy Attribute Certificate (EAC). It can be used to promote renewable energy production and reduce greenhouse gas emissions. What is a Renewable Energy Certificate (REC)? Concept of Renewable Energy Certificate (REC) A Renewable Energy Certificate (REC), also known as an Energy Attribute Certificate (EAC), is a certificate used to demonstrate […]

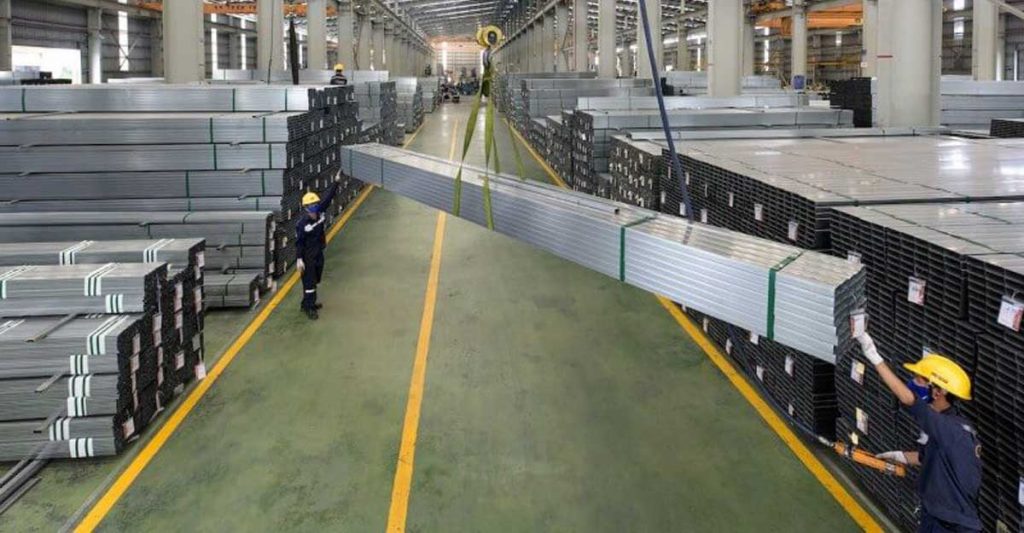

Iron and Steel Face EU’s CBAM Challenge: Greening for Competitiveness

As of October 1, 2023, the EU’s Carbon Border Adjustment Mechanism (CBAM) has officially entered its transition phase. Iron and steel is one of the first six industries to be impacted by the CBAM during this initial phase. The ‘greening’ challenge for iron and steel industry enterprises The transition phase of the CBAM runs from October 1, 2023, to December […]

15,000 Safe Man-Hours at a rooftop solar project in Dong Nai

On September 29, 2023, the project management of the rooftop solar power system celebrated a milestone of 15,000 safe man-hours at the construction site in Dong Nai. TotalEnergies, the project’s investor, recognized Vu Phong Energy Group’s achievement in ensuring safety throughout the project. Project Overview The rooftop solar power system has a total capacity of 1.15 MWp and construction commenced […]

Outstanding activities of Vu Phong Energy Group in September 2023

Vu Phong Energy Group collective stepped into September 2023 with excitement and abundant energy, initiating a meaningful sharing session to create an ideal work environment. This session occurred at the new office of Vu Phong Energy Group in Ho Chi Minh City – a more extensive, modern building located at 19 D8 Street, Caric Residential Area, An Khanh Ward, Thu […]

CBAM & Electricity Emissions: What Businesses Need to Know

During the transitional phase of the EU’s CBAM mechanism, importers of cement, steel, aluminum, fertilizers, and hydrogen products must report direct and indirect greenhouse gas emissions, including emissions from electricity use during manufacture. What may you not know about the carbon credit market? Ho Chi Minh City needs a breakthrough development mechanism to pioneer in neutralizing emissions VP Energy invests […]

Handover of solar power system at Kem Nghia factory

On September 15, at Tan Phu Trung Industrial Park, Cu Chi, Ho Chi Minh City, the handover ceremony of a 2.23 MWp rooftop solar power system of the factory of Kem Nghia (Nghia Nippers Corporation) took place. The ceremony was attended by Mr. Tu, Tran Minh – Deputy General Director of Kem Nghia; Mr. Thuong, Duong Van – Head of […]

Preparing for CBAM: How Vietnamese Businesses Can Adapt

In just a few days, the EU’s Carbon Border Adjustment Mechanism (CBAM) will officially enter its transitional phase, starting October 1, 2023. Proactively adapting to CBAM is a challenge for many businesses in Vietnam, especially those in industries like steel, aluminum, cement,… CBAM & Electricity Emissions: What Businesses Need to Know Ho Chi Minh City needs a breakthrough development mechanism […]

Collaboration signed for solar rooftop development at An Tien Industries factory

On September 8, 2023, An Tien Industries, VP Energy, and Vu Phong Energy Group joined in signing a collaboration aimed at developing a solar rooftop system at the An Tien Industries factory in the Southern Industrial Park, Van Phu Commune, Yen Bai City, Yen Bai Province. The system has a capacity of 2.56 MWp and will be developed through a […]

Vu Phong Energy Group accelerates the deployment of a series of solar power systems for businesses

In August, the Vu Phong Energy Group embarked on an accelerated deployment of solar power systems on businesses’ rooftops. Some of these systems are in the final stages and are expected to be completed in September 2023. Details of Vu Phong Energy Group’s outstanding activities in June, let’s read Vu Phong Magazine August 2023 Desktop Version: Read Magazine Mobile Version: […]

Many policy recommendations for the roadmap towards 100% renewable energy in Vietnam

On August 29, 2023, during the Seminar “Discussion on the energy transition roadmap towards 100% renewable energy and Net Zero in Vietnam,” many experts and energy industry leaders shared insights and discussed policy recommendations for achieving 100% renewable energy by 2050 in Vietnam. The seminar featured the participation of Mr. An, Pham Dang, Deputy General Director of Vu Phong Energy […]

Energy Solutions for Sustainable Cities

At the Smart and Sustainable City Forum 2023, held on the afternoon of August 23, 2023, both local and international experts discussed many energy solutions to meet the demands of developing cities in Vietnam. Mr. Phong, Pham Nam, Founder and Chairman of the Board of Directors of Vu Phong Energy Group, shared at the forum. Vietnam Energy and Technology Forum […]

TheLIGHT’s journey to bring light to remote area in Da Quyn Commune

With accompanied by Vu Phong Energy Group and JCI Dalat, TheLIGHT project under JCI East Saigon recently embarked on a journey filled with meaningful and memorable. Their mission is to provide solar power to the underprivileged residents of Makar, a remote community in Da Quyn commune, part of an ethnic minority and mountainous region in Duc Trong district, Lam Dong […]

50,000 corporations operating in Europe must report sustainable development

Approximately 50,000 companies must report on their sustainability efforts under the Corporate Sustainability Reporting Directive (CSRD). This includes both EU-based and non-EU corporations that operate within the EU. This directive will also indirectly affect many other businesses, such as those in the supply chain. How to Harness Solar Energy for Good and Profit Footwear enterprises use green standards to increase […]

Business Competitive Advantage from Sustainable Development Strategy

A sustainable development strategy has a considerable influence, representing social responsibility and being a decisive factor in a company’s success and sustainability. Building and carrying out a sustainable development strategy will assist businesses in creating long-term value, managing risks efficiently, adapting flexibly, enhancing efficiency and resource conservation, and improving brand image and consumer goodwill. This helps businesses gain a competitive […]

Opportunities and Challenges in Renewable Energy Development in Ho Chi Minh City

Renewable energy sources are acknowledged for Ho Chi Minh City’s significant contribution to environmental protection and sustainable development. Developing Renewable Energy in Ho Chi Minh City The topic of Voice of Vietnam (VOV) held on July 29 was “Developing Renewable Energy in Ho Chi Minh City – Opportunities and Challenges.” Mr. An, Pham Dang, Deputy General Director of Vu Phong […]

Sharing document – Electricity saving solutions for manufacturing enterprise

Electricity costs often account for a significant proportion of a manufacturing business’s overall operational expenses, impacting product pricing and profitability. Efficient electricity-saving measures may assist enterprises in optimizing their operating expenses while simultaneously reducing greenhouse gas emissions, contributing to environmental protection. Electricity Consumption in the Industrial Sector The industrial sector is the nation’s largest energy consumer, accounting for over 50 […]

VP Energy invests in a 1.5 MWp solar power system on the roof of Chien Thang Industrial Company Limited ‘s factory

The 1.5 MWp solar power system will be installed on Chien Thang Industrial Company Limited’s rooftop. This system was developed under a Power Purchase Agreement (PPA) cooperation model, invested by VP Energy and Vu Phong Energy Group provided EPC general contractor and operation and maintenance (O&M). On July 22, 2023, the signing ceremony took place. Collaboration for rooftop solar power […]

Carbon Capture and Storage (CCS) technology on the Journey to Net Zero

International experts recognize Carbon Capture and Storage (CCS) technology as a critical intermediate and long-term solution to achieve net-zero emissions. Understanding carbon capture and storage Carbon Capture and Storage (CCS) is a process that captures carbon dioxide (CO2) emissions from various sources and transports them to safe, long-term storage locations, such as deep geological formations underground or under the seabed,… […]

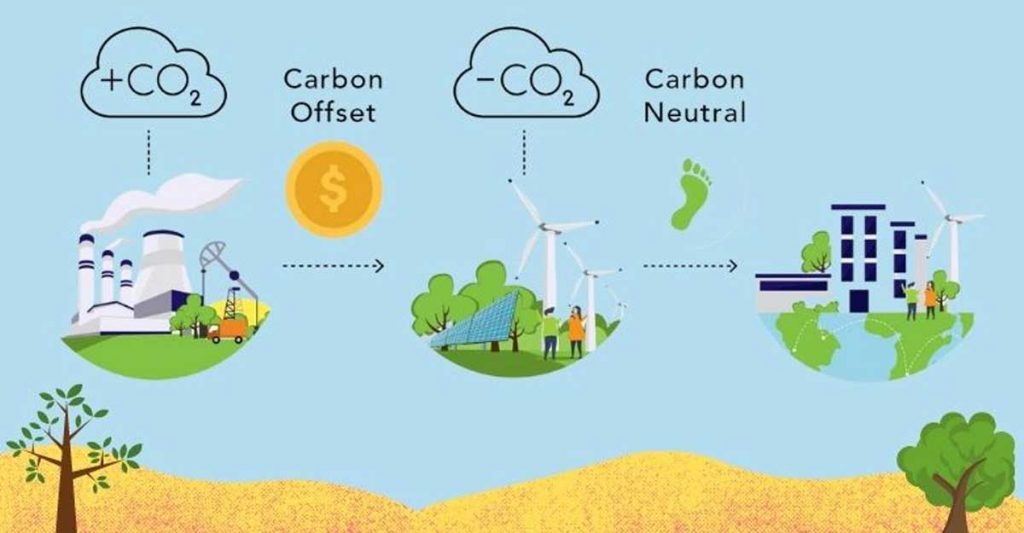

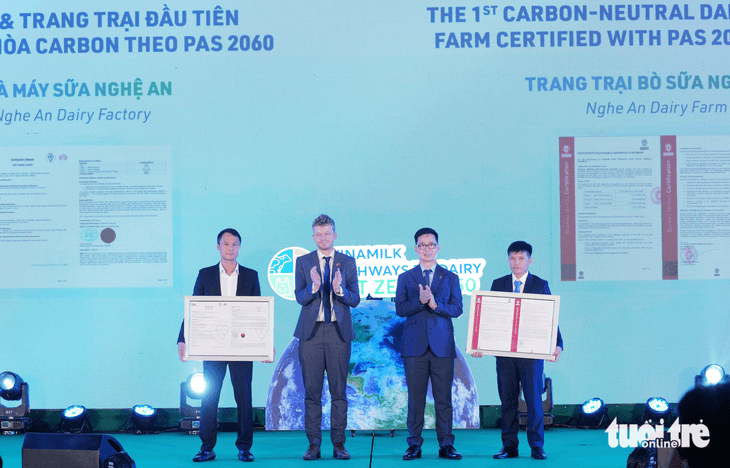

Reducing emissions and achieving carbon neutral – the essential pathway

Many green manufacturing and consumption businesses have long prioritized reducing greenhouse gas emissions and carbon footprint. However, with recent strong commitments and actions from Governments, reducing emissions and achieving carbon neutrality is not just a trend but a essential pathway for businesses to avoid being phased out of the market. The global trend With over 100 countries making strong commitments […]

Vu Phong Shares Pioneering Experience in Renewable Energy

“In terms of policy, I believe that self-consuming rooftop solar has a tremendous opportunity ahead of it. Many factories in industrial zones have yet to install rooftop solar systems,” shared Mr. An, Pham Dang, Deputy General Director of Vu Phong Energy Group, in June 30, 2023, in the panel discussion “The lessons learnt from the pioneer investors” at the Forbes […]

HCMC Installs Rooftop Solar on Public Administrative

In Ho Chi Minh City, administrative agencies and public service units will be permitted to install rooftop solar power systems. This is one of the mechanisms and policies recently approved by the National Assembly in Resolution No. 98/2023/QH15 on piloting a number of specific mechanisms and policies for the development of Ho Chi Minh City. Many opportunities for energy collaboration […]

Vu Phong Energy Group successfully organizes the Annual General Meeting of Shareholders 2023

The Annual General Meeting of Shareholders 2023 was successfully held on the afternoon of June 23, 2023, at the representative office at 61 Cao Duc Lan, An Phu Ward, Thu Duc City, Ho Chi Minh City. Vu Phong 2023 AGM: A Successful Gathering The meeting got a report on the Board of Directors’ activities in 2022 as well as the […]

Sustainable Development Goals: A Report on Global Progress

The Sustainable Development Goals Report (SDGs) is critical in assessing progress toward the SDGs at the global and regional levels. The United Nations conducted this report, which is updated yearly. In this article, we will explore the significance and components of a Sustainable Development Goals Progress Report, as well as provide an overview of some of the highlights from the […]

Vu Phong Energy Group works diligently to ensure HSE on construction projects

In May 2023, Vu Phong Energy Group engineers maintained the work on developing clean energy systems with the goal of early operation and transfer to producing enterprises. Health, Safety, and Environment (HSE) management is always given priority at each project, particularly when the Southern area approaches the rainy season with heavy rain and high winds. Please read Vu Phong Magazine […]

Energetically inspiring young people at the Social Impact Career Fair

Mr. An, Pham Dang, Deputy General Director of Vu Phong Energy Group, shared information on job opportunities in the renewable energy industry in the context of sustainable development at the workshop. On June 3, 2023, the workshop was held as part of the Social Impact Career Fair event at the University of Social Sciences and Humanities, National University of Ho […]

Tetra Pak nearly achieves goal of 100% renewable energy

Tetra Pak achieved an 84% renewable energy consumption rate in 2022 with 8.47 MW of solar power installed throughout their operations. Tetra Pak is taking another step in using renewable energy, reducing greenhouse gas emissions, and minimizing their carbon footprint in production operations by operating a 1.23 MWp solar power system on the roof of their factory in Binh Duong […]

The first farm and dairy factory in Vietnam Certified Carbon-Neutral

Vinamilk’s dairy farm and milk factory in Nghe An has recently received the PAS 2060:2014 Carbon-Neutral certification, making Vinamilk the first dairy company in Vietnam to achieve Carbon-Neutral at both the factory and farm. The total greenhouse gas emissions neutralized by these two units, according to Vinamilk’s report, are equal to 17,560 tons of CO2 (equivalent to nearly 1.7 million […]

Grand opening of Dalat Worsted Spinning – the worsted yarn spinning mill factory utilizing solar energy

On the morning of May 25, 2023, Dalat Worsted Spinning Limited Company opened the Dalat Worsted Spinning Factory – DWS. This is the first worsted yarn spinning mill factory in Vietnam with modern machinery and uses clean energy for production through a solar power system with a capacity of 2,04 MWp. The Dalat Worsted Spinning Factory – DWS of Dalat […]

Power Development Plan VIII: Rooftop solar power, self-generating and self-consuming are given special priority

According to the National Power Development Plan VIII for the period of 2021 – 2030, with a vision to 2050 (referred to as the Power Development Plan VIII), development orientation the electricity will promote the development of renewable energy sources, new energy, clean energy suitable with the ability to ensure system safety with reasonable electricity prices, especially self-generating, self-consuming and […]

What are the advantages of businesses pursuing sustainable development?

Sustainable development is known as a way of helping businesses to remain competitive in the market. And what are the unique advantages of enterprises moving toward sustainable development? Impressive textile factories rooftop solar power system Assessing Sustainable Development: Principles and Criteria From the urgent requirement of practice A sustainable development strategy that is closely linked to business goals is seen […]

Reducing emissions, carbon neutrality, and other terms

At the COP26 conference, over 100 nations committed to reducing emissions including Carbon neutral, achieving a net emissions level of zero, and reducing methane gas emissions… Reducing greenhouse gas emissions and developing low-carbon economies to achieve Net Zero emissions have become the mainstream global development journey. To learn more about this trend, Vu Phong Energy Group invites you to explore […]

Vu Phong Energy Group outstanding activities in April 2023

In April 2023, amidst record-breaking heatwaves or the “worst heat wave in Asian history,” the engineers at Vu Phong Energy Group continue to work tirelessly towards developing clean energy systems with the goal of early operation and system transfer to manufacturing businesses. Utilizing renewable energy and sustainable development not only helps businesses increase market competitiveness, but also contributes to reducing […]

C47’s profit-after-tax target for 2023 is 59.7%

The Board of Directors of Construction Joint Stock Company 47 (HOSE: C47), an associated company of Vu Phong Energy Group, presented the business plan for 2023 to the General Meeting of Shareholders at the Annual General Meeting (AGM) of Shareholders in 2023, with total revenue of 1,000 billion VND, after-tax profit of 25 billion VND, and a minimum dividend payout […]

The rooftop solar systems will have a significant role in the development of Ho Chi Minh City’s green economy

The development and use of clean and renewable energy sources, notably rooftop solar power, is a necessary solution that will greatly contribute to the construction and growth of a green economy in Ho Chi Minh City. This is the consensus of experts who spoke at April 18, 2023, Meeting “Building and Developing a Green Economy in Ho Chi Minh City,” […]

Vu Phong Energy Group’s outstanding activities in March 2023

In March 2023, Vu Phong Energy Group continued implementing projects and started a solar power system project at Dalat Hasfarm’s farm (Da Lat, Lam Dong). During the month, Robot VPT-RB1200-S1, 100% “Make in Vietnam” product of Vu Phong Energy Group, was also displayed at the “green economy” exhibition within the framework of the High-Quality Vietnamese Products 2023 announcement program and […]

Ho Chi Minh City needs a breakthrough development mechanism to pioneer in neutralizing emissions

Ho Chi Minh City has the potential to be pioneering in achieving emission reduction targets, the neutrality of greenhouse gas emissions, and the increased use of renewable energy. However, the locality requires some groundbreaking development mechanisms to exploit this potential fully. The Ho Chi Minh City National Assembly Delegation held a Meeting on March 30 to discuss and comment on […]

Successfully developing & transferring many rooftops solar power systems for businesses

In the context of an increasing number of businesses choosing to use solar power to reduce emissions and carbon footprint in their production activities, the PPA (Power Purchase Agreement) model pioneered by Vu Phong Energy Group is highly regarded for its practical and effective benefits. With this model, Vu Phong has developed and transferred a series of rooftop solar power […]

Robot 100% “Make in Vietnam” for green energy at green economy exhibition

Vu Phong Energy Group’s VPT-RB1200-S1 Robot for cleaning solar panels, a 100% “Make in Vietnam” product, was recently on display at the “green economy” exhibition as part of the program to announce the High-Quality Vietnamese Products 2023 on March 14, 2023, at Reunification Convention Hall (Ho Chi Minh City). Vu Phong Energy Group congratulates Vietnam Entrepreneur’s Day on October 13 […]

Kick-off of Solar Project at Dalat Hasfarm – A New Milestone in Sustainable Development

Dalat Hasfarm is taking a new step toward sustainable development by using clean energy from solar power – the PPA (Power Purchase Agreement) model invested in by ecoligo Fund (Germany), developed and provided EPC contracting services by Vu Phong Energy Group. The project’s kick-off ceremony was held on March 15, 2023. Reducing greenhouse gas emissions and promoting sustainability Vu Phong […]

Vu Phong Energy Group continues to implement a series of projects for manufacturing business

After the Lunar New Year holiday, in February 2023, Vu Phong Energy Group’s engineers resumed installing solar power systems to accompany manufacturing businesses on the “greening” journey towards sustainable development. Please read Vu Phong Magazine of February 2023: Desktop Version: Read Magazine Mobile Version: Read Magazine One of the currently highlight projects being implemented by Vu Phong Energy Group is […]

15 years – A beautiful story of a green journey

When the Vietnamese market was still unfamiliar with the term “renewable energy,” a group of engineers researched, developed, and produced solar kits, charge controllers, and power converters,… for places without grid electricity, opening the very first small off-grid solar market. That was the story in 2008-2009, more than a decade ago… Vietnam’s leading professional solar EPC contractor The journey to […]

C47 prioritizes hydroelectric and irrigation projects in Vietnam and Laos

Construction Joint Stock Company 47 (HOSE: C47), an associated company of Vu Phong Energy Group, has mobilized nearly 100 types of equipment, vehicles, and machines,.. as well as nearly 200 personnel, to carry out the construction of the Nam Pha, Nam Phak, and Phouphong Dams as part of the Nam Phak Hydropower Project (Lao). C47 has excavated nearly 500,000 cubic […]

Cooperation to develop 3,500 kWp solar power on Quang Quan plastic factory chain

Three solar power systems totalling 3,500 kWp will be installed on Quang Quan Co., Ltd.’s plastic factory chain.. The Power Purchase Agreement (PPA) cooperation model will be used to develop the project, with VP Energy as the investor, Vu Phong Energy Group as the General Contractor – EPC, and Quang Quan as the system user. The signing ceremony for the […]

Electricity price is in the “waiting to increase”, should businesses choose… waiting?

The average retail electricity price (excluding VAT) has been raised by 220-537 dong per kWh. The Ministry of Industry and Trade has also issued a document requiring Vietnam Electricity to prepare a proposal for the average retail electricity price in 2023, as well as the route and suitable adjustment level in the case of a rise in electricity prices soon […]

Unprecedented driving force for renewable energy development

The International Energy Agency (IEA) has revised projections for the increase of renewable energy sources, predicting an almost 2,400 GW increase between 2022 and 2027. Notably, this is the IEA’s highest revision increase yet, about 30% higher than the prediction issued at the end of 2021. IEA: Global renewal power will reach 4,800 GW in the next 5 years Proactive […]

Transparent solar panels for windows hit record 8% efficiency

The demand for sustainable and renewable energy sources has never been greater. As we strive to reduce our carbon footprint and transition to a greener future, innovative solutions like transparent solar panels are gaining traction. These cutting-edge devices offer a unique approach to harnessing solar energy, combining functionality with aesthetics. In this article, we will explore the latest advancements in […]

Ensuring Continuous Power: The Benefits of Back Up Solar Power Systems

In today’s modern world, where electricity powers nearly every aspect of our lives, the need for a reliable backup power system cannot be overstated. Whether it’s a sudden blackout caused by inclement weather or a planned maintenance outage, being without power can disrupt our daily routines and jeopardize critical functions. That’s where back up solar power systems come into play, […]

Vu Phong Magazine Special Issue: Strengthening Transformations 2022

A special magazine to welcome the Lunar New Year 2023, as a document of Vu Phong Energy Group’s journey in 2022, with the trust and companionship of all Customers and Partners. Sincerely introduce to you: Vu Phong Magazine Special Issue – Strengthening Transformations 2022: Let’s check Vu Phong Magazine Special Issue – Strengthening Transformations 2022: Version desktop: Xem Magazine Version […]

3 critical factors that contribute to the quality of a solar power system operation

In the quest to meet environmental regulations and reduce energy costs, the quality of a solar power system has emerged as a crucial factor. Many businesses are now embracing this clean energy alternative, marking a significant shift towards sustainable development and emission reduction. Vietnam’s leading professional solar EPC contractor Clean energy for manufacturing greening production The Vu Phong Energy Group, […]

Flexible Rooftop Solar Power A Key to Sustainable Energy

The adoption of a Rooftop Solar Power policy, characterized by its flexibility, stands to create a favorable landscape for investors and manufacturers alike. Such a policy would pave the way for the widespread adoption of clean energy solutions, offering a dual advantage: it would facilitate a greener footprint for businesses while also providing a lucrative avenue for investment in sustainable […]

Vu Phong Energy Group sets new target for outstanding growth in 2023

Vu Phong Energy Group is committed to achieving outstanding sales growth in 2023, with a target of a 50% increase in sales compared to 2022 despite the fact that it is anticipated that the global economic and political climate will present numerous obstacles. In the tense days preceding the Lunar New Year of 2023, Vu Phong Energy Group held an […]

Sustainable Development: Principles and Criteria

Sustainable development, according to Agenda 21, is defined as development that meets the needs of the current generation without jeopardizing future generations’ ability to meet their own needs. It is a well-balanced development in terms of socioeconomic and environmental factors… Economically sustainable development Economically sustainable development is defined as rapid, safe, and high-quality growth in all aspects of the economy […]

The Vu Phong Energy Group team is proactive in preparing for the new journey in 2023

In the last days of 2022, the Vu Phong Energy Group team met and participated in an exciting internal training program to enable each person actively develop, maximize the potential of each other in team engagement to accomplish work and life goals together. The Impact plan & Self-worth optimization training program was held with energy and a spirit of proactive […]

Vu Phong Energy Group handed over a solar power on the rooftop of the first worsted yarn spinning mill in Vietnam

A solar power system with a capacity of 2,04 MWp has just been installed on the rooftop of Dalat Worsted Spinning – DWS, one of the major enterprises in the Phat Chi industrial complex in Da Lat city, as well as the first worsted yarn spinning mill in Vietnam. Reduce greenhouse gas emissions with a series of rooftop solar energy […]

Vu Phong Energy Group – The Best C&I rooftop solar power project in South East Asia

Vu Phong Energy Group was recognized in the Best C&I Project Award: Rooftop (Industrial) category at the C&I Energy South East Asia Leadership Awards 2022. This is Vu Phong Energy Group’s second consecutive award, after TotalEnergies’ The 2022 Best EPC Contractor in Vietnam award in December. C&I Energy South East Asia Leadership Awards 2022 is an award hosted by Solar […]

Partnership for the development of a rooftop solar power plant for Duy Tan Binh Duong Plastics

On the rooftop of Duy Tan Binh Duong Plastics (belonging to Duy Tan Plastics Group) will install a solar power system with a capacity of 2,17 MWp. The system has been developed according to the PPA (Power Purchase Agreement) model, with BayWa r.e. Vietnam as the investor, Vu Phong Energy Group as the project developer and provides the service of […]

Proactive energy price for businesses: European lessons

The energy crisis has become an obsession of many European businesses as they are obliged to decrease production and raise product costs – which implies that competitiveness is severely reduced, even forcing factories to close… Businesses struggle when energy price rises Europe has been facing an energy crisis since the Russia-Ukraine war in February. Despite attempts to enhance energy supplies […]

Vu Phong Magazine of November 2022 – Acceleration for the finish stage

As the year 2022 ends, the Vu Phong Energy Group team, particularly the construction team, is working hard to complete projects and meet the 2022 goal. In November, Vu Phong Energy Group attended and shared at the 2nd Asian Global Solutions Summit, held by JCI Japan; as well as attended the handover conference and signed a commitment to operate and […]

Vu Phong Energy Group was honoured as The 2022 Best EPC Contractor in Vietnam by TotalEnergies

Vu Phong Energy Group was honoured by TotalEnergies as The 2022 Best EPC Contractor in Vietnam on December 01, 2022, at TotalEnergies’ office in Vietnam and was awarded a certificate for outstanding achievements without any incidents in all projects. Vietnam’s leading professional solar EPC contractor Vu Phong Energy Group cooperates to implement rooftop solar power system of Dong A Plastic […]

Many businesses develop smart, modern and sustainable factories

26 enterprises have received assistance in developing smart factory models, with some businesses recording significant improvements in maximizing the system via activities, such as Kem Nghia (Nghia Nippers), Liksin Packaging Enterprise (Liksin Corporation),… Project to train experts and support the development of smart factories The Ministry of Industry and Trade has implemented the Smart factory development support project in collaboration […]

Four price framework options for transitional wind and solar power projects

Vietnam Electricity (EVN) performs four options for calculating price frameworks for transitional wind and solar projects based on input data such as investment rate; average forwarding power; corporate income tax; foreign currency/local currency loan ratio; interest rates on domestic and foreign currency loans… of projects provided by investors. Option 1‘s total investment value is smaller than the total investment value […]

Excellent operation of BIM 2 Solar Power Plant for three consecutive years

Through initiative and professionalism, engineers from Vu Phong Tech – Vu Phong Energy Group gradually mastered the technology and consistently achieved excellent results in the operation and maintenance of the BIM 2 Solar Power Plant (Thuan Nam, Ninh Thuan). Excellent operation of BIM 2 Solar Power Plant for three consecutive years Vu Phong Tech accompanies BIM Group at the Green […]

COP27 Climate Finance The Trillion Dollar Hurdle to Net Zero

In our collective quest to achieve our Climate Finance objectives, we have witnessed a surge of commitments aimed at reducing greenhouse gas emissions and achieving carbon neutrality. These commitments are part of a comprehensive suite of strategies crafted to address the growing menace of climate change. Drive action for global climate goals COP26: Joint voice to protect the future of […]

Solar power lights up many dreams in Yen Thuy, Hoa Binh

Four preschools in the hilly area of Yen Thuy, Hoa Binh province, Lac Luong, Lac Sy, Lac Hung, and Huu Loi have received solar power systems with a total capacity of more than 32 kWp. This is the outcome of the project “Solar energy solution for preschools in four project communes under the Yen Thuy Area Program” – one of […]

COP27: Stepping Up Action for Global Climate Goals

In pursuit of global climate goals, a massive congregation of over 400,000 delegates, symbolizing world leadership, convened at COP27. This followed the firm pledges made at COP26. Their unified objective was to brainstorm and identify effective strategies to accelerate actions towards meeting their commitments and tackling the universal challenge of climate change. COP26: Joint voice to protect the future of […]

Solar Energy at Vinamilk’s mega dairy factory

Solar power system with a capacity of 3,39 MWp, using 7,542 high-efficiency solar panels and 27 110 kW inverters, installed at Vietnam Dairy Factory – the most modern mega factory in Vietnam and the area, with the most modern integrated and automatic technology in the world. Vinamilk is known as a strong and typical national brand, with a success story […]

Cooperation to promote carbon neutrality in Asia

On September 2, 2022, at the 2nd Asian Global Solutions Summit organized by JCI Japan, delegates shared many carbon neutrality initiatives in Asian countries such as Japan, Korea, India, New Zealand, Vietnam, Singapore, Thailand… and toward cooperation for the common goal of sustainable development. Within the framework of JCI World Congress 2022, the 2nd Asia Global Solutions Summit was organized […]

The solution to optimizing the performance of operating solar farms

The Solar Show Vietnam 2022, Vietnam’s biggest exhibition of renewable energy equipment, was held in Ho Chi Minh City on October 27-28. Mr. Trinh, Vo Xuan, Technical Director of Vu Phong Energy Group, participated in the exhibition with representatives from energy companies such as TTC Group, Bureau Veritas, Meteocontrol, and Sense Hawk, discussing solutions to optimize the performance of operating […]

Vu Phong Energy Group’s spirit at BK Marathon 2022

The BK Marathon 2022 was held on October 23, 2022, with a large number of athletes participating. This is a large-scale sporting event held by the Ho Chi Minh City University of Technology (HCMUT – Bach khoa) – Vietnam National University Ho Chi Minh City in collaboration with the Representative Board of Bach Khoa Alumni (BKA) Community on the occasion of the […]

Recent Posts

- The Potential Of The Carbon Credit Market In Ho Chi Minh City

- Businesses must proactively participate in the carbon credit market

- Highlight activities of Vu Phong Energy Group in march 2024

- Chairman of the BODs of Vu Phong Energy Group met and shared with Ho Chi Minh City leadership and community of innovation and creativity

- Greenhouse gas inventory and carbon neutrality consulting services – Net Zero for businesses

Categories

- CBAM 10

- CSR 25

- Energy News 234

- ESG 53

- Solar Applications 55

- Solar Technical 47

- Vu Phong News 153

Recent Posts

-

The Potential Of The Carbon Credit Market In Ho Chi Minh City

-

Businesses must proactively participate in the carbon credit market

-

Highlight activities of Vu Phong Energy Group in march 2024

-

Chairman of the BODs of Vu Phong Energy Group met and shared with Ho Chi Minh City leadership and community of innovation and creativity

-

Greenhouse gas inventory and carbon neutrality consulting services – Net Zero for businesses